8th November 2017 marked the first anniversary of demonetization. The Government of India, yesterday, celebrated an “Anti-Black Money Day”; on the other hand, the opposition declared it as a “black day”.

A year earlier, Prime Minister Narendra Modi made a drastic decision on November 8th, 2016, and India was plunged into chaos. Prime Minister, in a surprise television announcement, declared that some ₹14 trillion worth of ₹500 and ₹1000 notes (amounting 86% of all the currency in circulation in India) would become illegal as of midnight, People would have until the end of the year to deposit them in bank accounts, but they were no longer legal tender. Just like that, billions of currency notes suddenly became unusable.

The objective, Modi said, was to fight black money, to eliminate the counterfeit notes that were reportedly printed by Pakistan to fuel terrorism against India. To force out stashed cash people had hidden to avoid paying taxes. To be honest, if properly implemented, with due preparation, demonetization could have been a GREAT policy with some long-lasting positive impacts. But the question is did it??? To answer this bigger question, let’s start with smaller ones.

Was demonetization a successful move to curb the Black money?

Various government agencies had initially estimated that around 25 to 35% of the demonetized banknotes would not be deposited by the stipulated dates. On November 23rd, 2016, the Attorney General of India told the Supreme Court of India that the government expected that notes worth four to five lakh crores would be rendered worthless by not being deposited.

Unfortunately, all black money is not cash. In fact, most of India’s black money has been invested in real estate and other forms of property, gold and jewelry, investments in property abroad, and “round-tripping” that has seen the money return to India’s stock market as “foreign investment” via countries like Mauritius. The Modi move, therefore, touches only a small proportion of black money assets.

Data released by the Reserve Bank of India (RBI) clearly indicates that demonetization has failed to flush out black money. Nearly 99% of the scrapped notes were deposited into the country’s banks and have re-entered the country’s monetary system. Data published on the anniversary of demonetization showed that 3.68 lakh crore rupees of suspicious cash were deposited in 23.22 lakh bank accounts. Each of these cases is being investigated and sources said one lakh entities are set to get IT notices. Demonetization has paved the way for action to be taken against those who have illegally hoarded money. But, seems like it was “khoda pahad nikali chuhiya“

And, since corruption seems to be a way of life in India, it will not be long before the old habits of under-invoicing, fake purchase orders and bills, reporting non-existent transactions, and straightforward bribery all generate new black money all over again. The government’s plan is therefore likely to be ineffective beyond the short term since it does nothing to control the source of black money.

Did we achieve the objective of thwarting counterfeiting?

Let’s first understand how big this problem was, A study conducted by the Indian Statistical Institute in Kolkata, under the supervision of the NIA, estimated that the value of fake Indian currency notes in circulation was about ₹400 crores, which amounted to only roughly 0.03% of the withdrawn currency. It also indicated that the ability of banks to prevent counterfeit notes was limited since their machines often fail to identify fake notes and due to the overwhelming pressure of the high level of deposit activity in the 50-day window period, bank employees could not make the sufficient manual effort to identify fake notes. As a result, far from hurting counterfeiters, demonetization may have helped to legitimize fake currency by having it exchanged, amid the chaos, for new notes.

Many media reports confirm that counterfeit bills of our freshly designed currency notes are already in circulation. Even RBI stated that the government’s freshly minted 2,000 rupee notes, issued after demonetization, are already being counterfeited.

This could, however, have been prevented by enmeshing strong security features with the design. It seems that the government has missed the opportunity of ensuring the adoption of new security features in the new ₹500 and ₹2000 currency notes. This indicates a lack of foresight and inadequate planning on the government’s part. There appears to be no special new watermark, no security thread or fiber, no new latent image, and certainly no nano chip, as BJP supporters were boasting on social media!

What the government did was a mere change of color and size. Was that enough to render the notes safe? Shockingly, RBI has admitted that two different versions of the ₹500 note have been printed in haste. If all versions are authentic, one can reasonably assume that this is going to confuse the public and make it easier for counterfeiters to get away with their own fake versions.

Again, If this was not enough, the RBI suffered a loss printing new currency notes — the cost of printing notes was nearly $900 million in 2016-17, which is double the $450 million spent a year prior. So, I guess, this objective has not been met, either.

Does the vision of “Cashless India” become reality?

When criticism erupted, the government said demonetization would also help India switch from cash to digital money. an idea and a phrase that was not mentioned even once in Prime Minister Modi’s original speech on November 8th, 2016. A lot of people from the major Tier 1 and Tier 2 cities quickly moved on to e-payment modes like net banking or using e-wallets like Paytm. Digital transactions have increased by 300 percent. Analysts predict that at the current rate millions of people will start using electronic payments and online payment options and move into the cashless mode, creating long-term benefits for themselves and the economy as well. But, small-scale industries in rural India which are dependent entirely on cash sales were deeply affected. The fact is that the digital infrastructure for “cashlessness” simply does not exist in India.

“Are we to assume that daily wage earners, small-time farmers and sundry hawkers who don’t even know what is a bank will be happy to see the country getting rid of cash, rather than vague things like illiteracy and poverty?” — T.J.S. George. (columnist)

A mere 34.8 percent of the country has internet access { It’s not a secret that India offers some of the slowest broadband speeds in the world } And, most mobile applications and internet banking websites are largely available in English, a language not understood by a majority of the people. Also, most Indians use cards just to withdraw cash from ATMs.

There are also awful deficiencies in cyber-security. the government’s drive for cashlessness may be creating new vulnerabilities and new victims.

“India’s digital state (ranked 42nd out of the 50 countries we studied in our Digital Evolution Index), does not engender the threshold of trust needed for cashlessness to take hold in a meaningful way.” — Harvard Business Review.

Worse still, there is a transaction cost involved in each digital payment that is absent on any cash exchange. so, using “less cash” actually involves more expenditure for the payer. This obviously affects ordinary citizens who are used to cash, which involves no transaction costs for them. It is also expensive for merchants to adopt digital payments, which affects them adversely.

And the government is doing nothing to ensure point-of-sale machines are made available to small retail outlets, free of cost or to remove charges for all cashless transactions. The financial implications of moving to a “less-cash” economy have raised related concerns.

There are allegations that the real beneficiaries of demonetization are the handful of companies that specialize in digital payments. In addition, digital transactions, by leaving a traceable record, add to the state’s ability to monitor individuals’ expenditures. As former Finance Minister P. Chidambaram asked,

why should a young adult be forced to disclose that she bought lingerie or shoes or he bought liquor or tobacco? Why should a couple be forced to leave a trail of a private holiday? Why should an elderly person leave a record that he bought adult diapers or medicines for his ailments? Why should the government or its numerous agencies have access to our lives through access to Big Data?

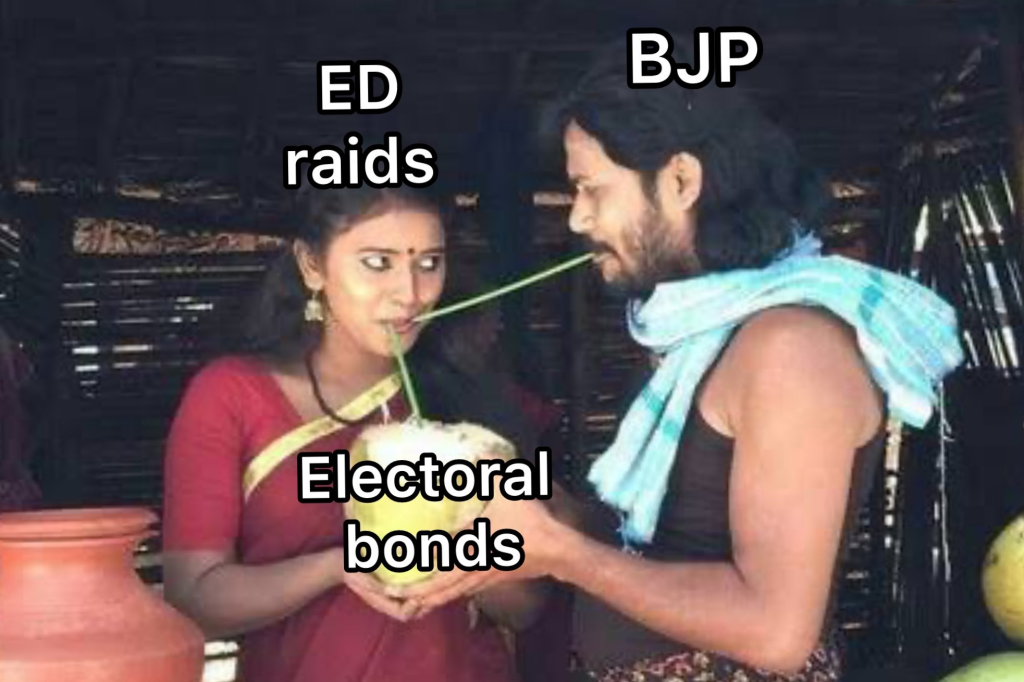

There are also some serious concerns about the legality of the demonetization process. The Bhartiya Janata Party reportedly bought crores of the worth of land just days before Prime Minister Narendra Modi’s demonetization announcement. the speed at which these lands were bought and the timing of it does raise suspicions about the party’s policy. Anyway, I don’t want to take this article into political akhada, so, let’s skip to more legal argument,

I guess we all can remember the initial stunned reaction of people, followed by the lines formed at banks, with people waiting for days, only to find that banks did not even have a fraction of the money needed to meet the demand for new notes. Because there was not enough new currency printed before the announcement. That’s why the government restricted withdrawals to small amounts of cash that most people found insufficient.

I remember a question raised by Dr. Shashi Tharoor in the parliament, to which Finance Minister had no satisfying answer.

Under which provision of law can an Indian citizen be denied access to the money in his or her own account?

The entire demonetization exercise had been conducted by the issuance of gazette notification no. 2652 by the Joint Secretary, Finance, under Section 26(2) of the Reserve Bank of India Act of 1934. This provision gives the Union government the limited power to demonetize certain series of the country’s currency through a notification. This provision does not, however, give the government the power to freeze bank accounts through limits on cash withdrawals, disrupt normal banking operations, and impose mandatory disclosure requirements (such as identity cards) while depositing cash into bank accounts or exchanging old notes.

In the name of “sacrifice“, we the people of India didn’t complain about it. If that was not enough, to test our patience even the ATMs were largely empty, since the new notes had been made in a different size from the old ones and did not fit the existing ATMs. This needed a re-calibration process which took thousands of engineers several months to complete.

This was an additional complication for a country like India where the fact is that there are not enough ATMs. India has only 20 ATMs per 100,000 people, as compared to 76 in China, 279 in South Korea.

This shortage of currencies has basically led to tightening liquidity in the market, thereby forcing people to spend less and that too on necessary products. This might lead to the cooling of the inflation in a while. Also, lesser spending implies more savings. The liquidity crisis also had a dark side which badly affected many sectors in general and particularly the agricultural sector.

A study by two economists at Delhi’s Indira Gandhi Institute of Development Research found that in mid-November 2016, deliveries of rice to rural wholesale markets were 61% below usual levels, soybeans were down 77%, and maize nearly 30%. The winter crop could not be sown in time, because no one had cash for seeds, and the resultant harvest was lower than projected.

All this has been hugely destabilizing in the short term. Let’s hope that this will be proved to be a good step in terms of the long run.

The damage that demonetization caused to the reputation of RBI.

Demonetization has caused serious and seemingly lasting damage to the image of the RBI, which conspicuously failed to exercise its autonomy, to anticipate the problems of Modi’s scheme, prepare its implementation better, and alleviate its impact. The United Forum of Reserve Bank Officers and Employees wrote to the Government on January 13th, 2017, pointing to operational mismanagement, which has dented RBI’s autonomy and reputation beyond repair. This entire decision-making process was a Government exercise trampling on the autonomy of the RBI, rather than a decision of the institution meant to be in charge of India’s monetary policy.

Impact of demonetization on terrorism :

Prime Minister Modi also cited among his objectives the undermining of terrorist and subversive activities. On December 27th, he even said that

“through the note ban, in one stroke, we destroyed the world of terrorism, drug mafia, human trafficking, and the underworld.”

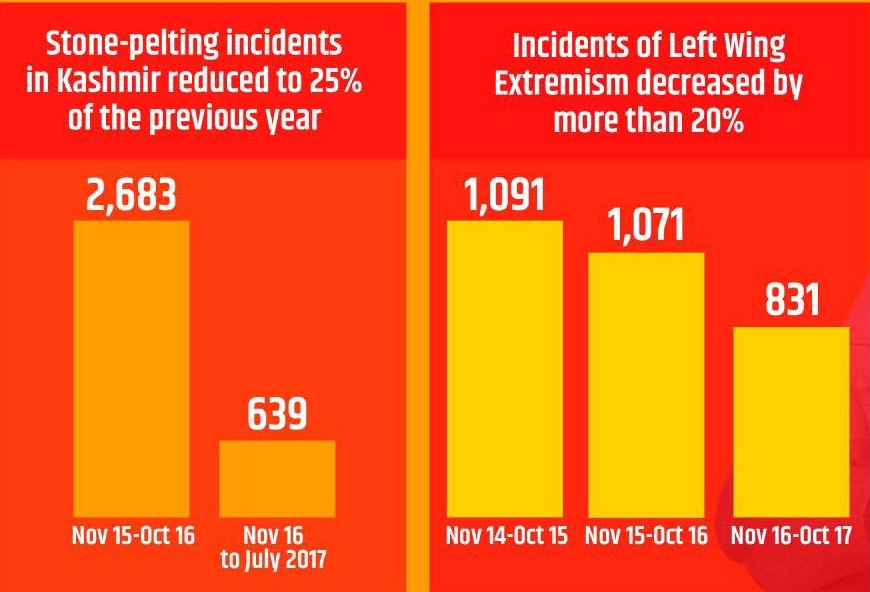

Though, the data on terrorist strikes and fatalities from the South Asian Terrorism portal shows that it is very difficult to establish a causal relationship between the number of terrorist strikes on Indian soil and the absolute levels of currency in circulation, It seems like demonetization has helped to tighten the noose around terrorists and Naxalites. As the incidents of Naxal violence declined after the demonetization. Stone pelting incidents also reportedly dropped to just one-fourth of the previous year in the Kashmir valley.

How demonetization affected the Indian economy?

India’s GDP growth slumped to a three-year low of 5.7%. The Economic Survey 2016–2017 released by the Chief Economic Advisor to the government itself states that the cash crunch must have affected the informal economy, which accounts for nearly half of the overall GDP and about 80% of the employment economy. The same survey also accepts that demonetization resulted in growth slow[ing], as demonetization reduced demand and supply, and increased uncertainty and job losses, the decline in farm incomes, social disruption, especially in cash-intensive sectors.

According to the All-India Manufacturers’ Organization (AIMO), macro and small-scale industries and traders have incurred 60% job losses and a 47% revenue loss because of demonetization. Not only are small and medium-sized enterprises shutting down; medium and large infrastructure companies surveyed by AIMO have reported a 35% drop in employment and a 45% drop in revenue. AIMO estimated even higher losses of jobs and revenue by the end of March. And to get back on their feet, to attract the customers, Infrastructure companies reduced the real estate prices and offered cheaper homes which were made available under the Prime Minister’s Housing Scheme, fulfilling the dreams of many to own their own homes.

While demonetization had severely affected several small and medium businesses, India’s internet start-ups grabbed the opportunity. For instance, Within 15 hours of Modi’s announcement, Ola saw an increase of 15 times in recharge volumes on its e-wallet. Paytm have seen a surge in new registrations as people move from cash to digital payments.

How much did it helped in the creation of bank accounts?

The burden of demonetization has most negatively affected the poor lower unskilled segment laborers hard since most of them don’t have a bank account, as the Harvard Business Review puts it,

“this unfortunate crisis is a case study in poor policy and even poorer execution. Unfortunately, it is also the poor that bear the greatest burden.”

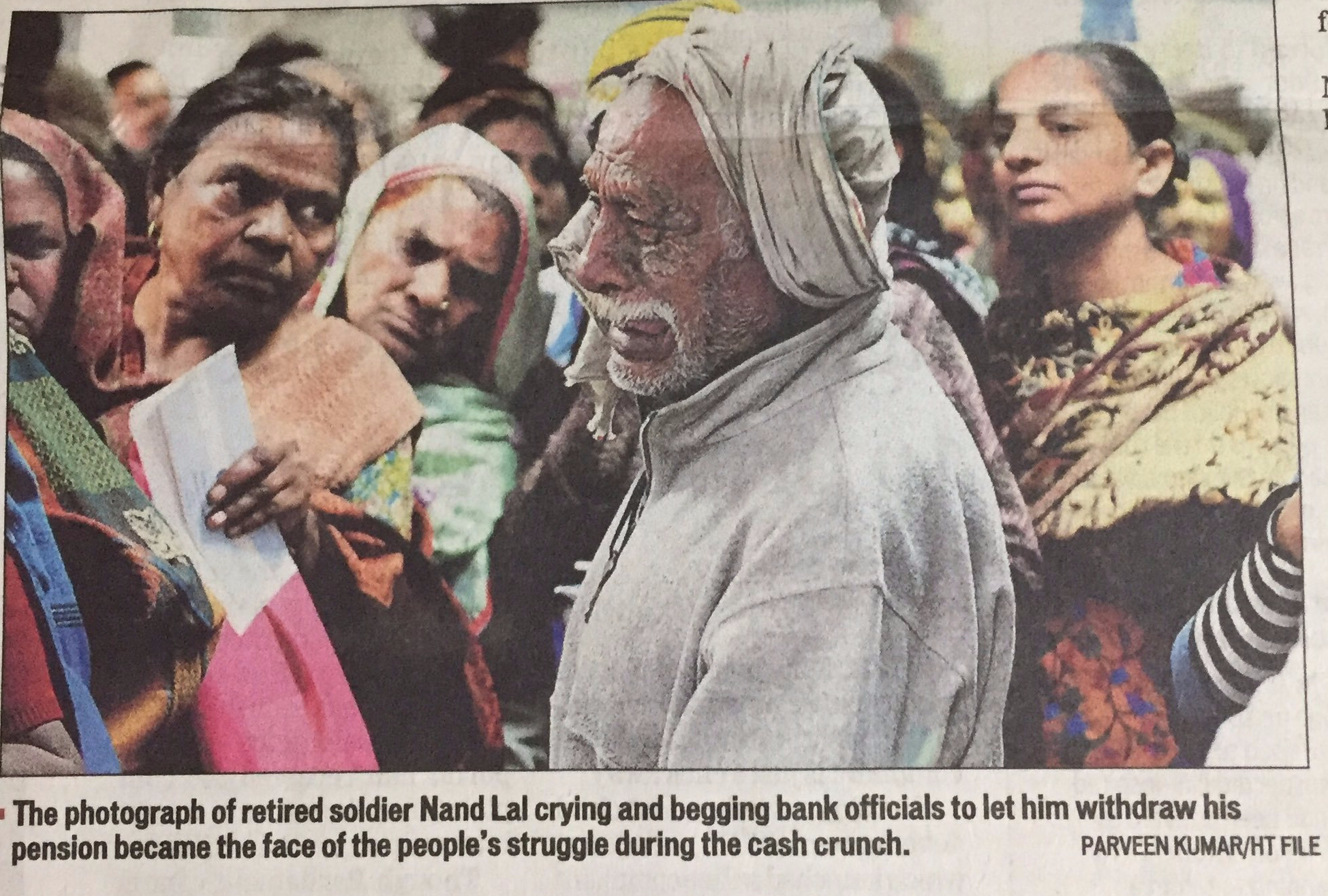

But we must acknowledge the fact that it has also encouraged many of them to open their own bank account in order to deposit the now-illegal notes, in turn helping Modi’s Jan Dhan Yojana. One of the biggest achievements of this entire chapter of demonetization was the fact that 56 lakh new taxpayers were connected to the country’s tax system. At the same time, there was a huge increase in the number of filing of tax returns compared to the previous year. Direct and indirect tax collections have also increased. If you ask me the most painful thing about demonetization then I would remind you that 135 people reportedly died, most of them were elderly citizens waiting outside banks for days and the overworked bank employees. Ironically, the rich have been relatively unaffected; the main victims have been the poor and the lower middle-classes, who rely on cash for their daily activities.

Undoubtedly, It was a bold and brave step from a political perspective. But it was also ill-planned, poorly thought through and badly implemented.

The collateral damage of the demonetization is so extensive that the pain it has inflicted outweighed any gain, at least in the short term.

— Mahesh Mali. An ordinary citizen of the India.

Leave a comment